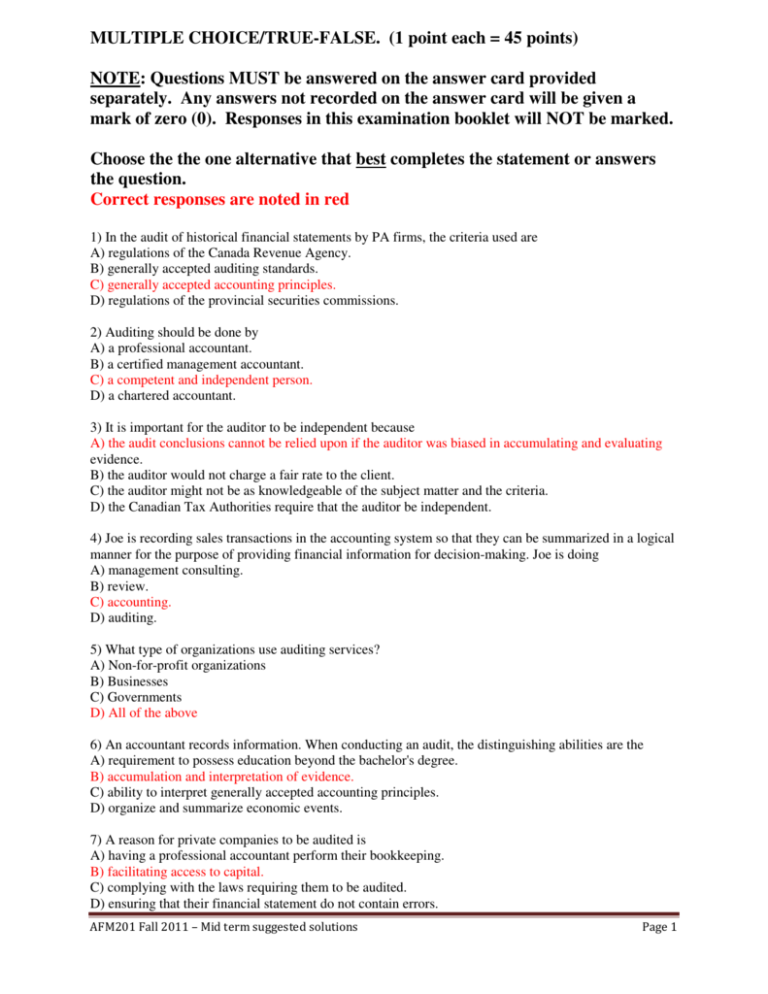

An Audit of Historical Financial Statements Most Commonly Includes the

Organization is operating efficiency and effectively b. C statement of cash flows balance sheet and the statement of retained earnings D balance sheet income.

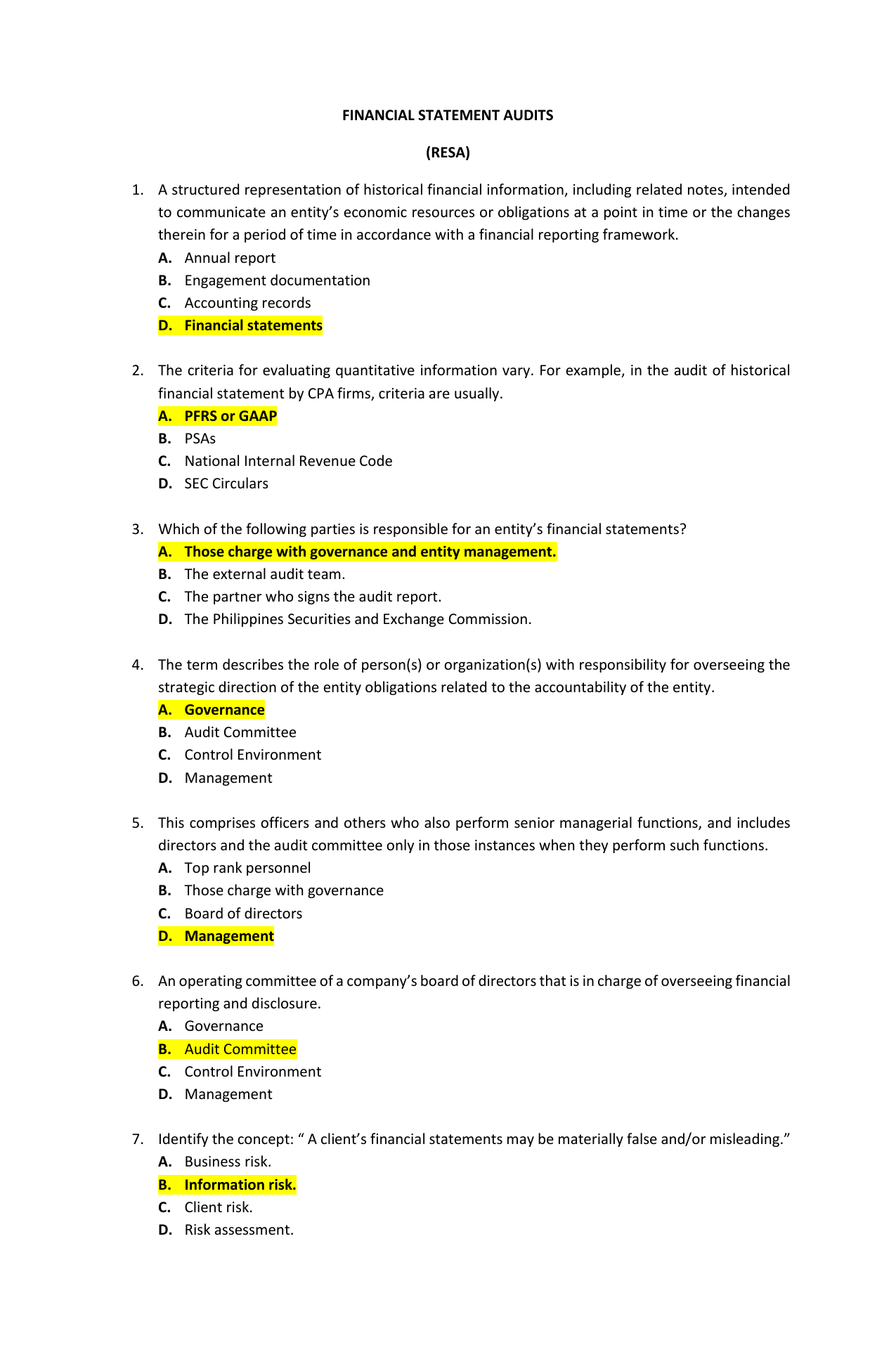

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Up to 25 cash back An audit of historical financial statements most commonly includes the.

. Financial statements are often audited by government agencies accountants. This information is used by a wide range of stakeholders eg investors in making economic decisions. After the audit the third party usually releases an audit opinion about.

1 income statement 2 balance sheet 3 cash flow and 4 rates of return. An audit of historical financial statements most commonly includes the. Balance sheet the income statement and the statement of cash flows.

B income statement the statement of cash flows and the statement of net working capital. The most commonly used criteria are applicable US. Balance sheet the income statement and the statement of cash flows.

The term audit usually refers to a financial statement audit. Involves gaining an understanding of the business and the business environment in which it operates and using this information to assess whether there may be risks that could impact the financial statements. An audit of historical financial statements most commonly includes the A balance sheet statement of retained earnings and the statement of cash flows.

Balance sheet statement of retained earnings and statement of cash flows b. Audit sampling is an investigative tool in which less than 100 of the total items within the population of items are selected to be audited. Financial statements are written records that convey the business activities and the financial performance of a company.

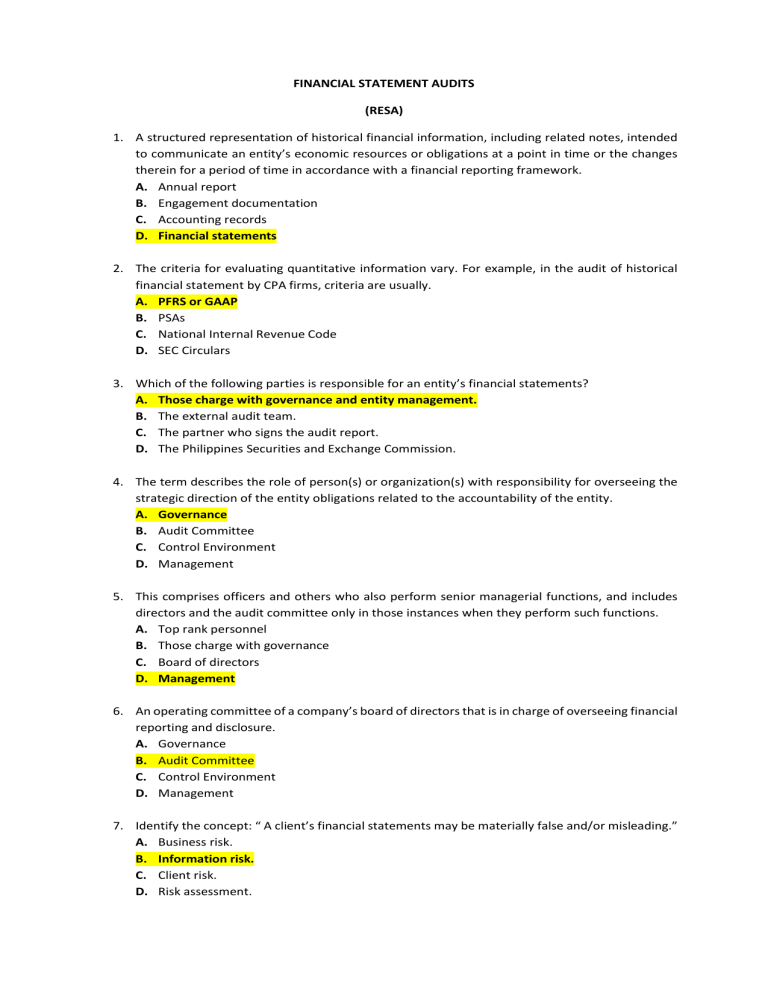

Broadly defined the subject matter of any audit consist of a. A financial audit is an objective examination and evaluation of the financial. Planning and risk assessment.

1 An audit of historical financial statements most commonly includes the. Stakeholder is any individual group or party that has an interest in an organization and the outcomes of its actions. Statement of cash flows balance sheet and the statement of retained earnings.

Reviews of any historical financial information of an audit client. Or international accounting standards. During a financial audit the auditor analyzes the fairness and accuracy of a businesss financial statements.

Income statement the statement of cash flows and the statement of net working capital. B income statement the statement of cash flows and the statement of net working capital. Purpose of a financial statement audit Companies produce financial statements that provide information about their financial position and performance.

Statement of cash flows the balance sheet and the retained earnings statement. Up to 25 cash back In the audit of historical financial statements what accting criteria is most common. Regulatory accounting - Answered by a verified Business Tutor.

B income statement the statement of cash flows and the statement of net working capital. Income statement the statement of cash flows and the statement of net working capital. A The information used by a CPA firm in a financial statement audit is the financial information in the companys financial statements.

First it makes the simple statement that the CPA firm has done an audit. An audit of financial statements is conducted to determine if the a. This is the most commonly conducted type of audit and is required for all publicly-held companies.

B income statement the statement of cash flows and the statement of net working capital. Second it lists the financial statements that were audited including the balance sheet dates and the accounting periods for the income statement and statement of cash flows. Entity is following specific procedures or rules set down by some higher authority.

These three core statements are. This guide is designed to be useful for both beginners and advanced finance professionals with the main topics covering. The primary stages of an audit are.

An audit of historical financial statements most commonly includes the. In this free guide we will break down the most important methods types and approaches to financial analysis. PSRE 2400 Engagements to Review Financial Statements as amended by the AASC in February 2008 applies to a.

A financial audit is one of the most common types of audit. A balance sheet statement of retained earnings and the statement of cash flows. Typically those that own a company the shareholders are not those that manage it.

1 An audit of historical financial statements most commonly includes the. Common examples do not make decisions based on faulty financial statements. B The information used by an IRS auditor is the financial information in the companys federal tax return.

Income statement statement of cash flow and teh statement of net working capital c. Most types of financial audits are external. An audit of historical financial statements is most often performed to determine whether the.

An audit of historical financial statements most commonly includes the. Auditors review transactions procedures and balances to conduct a financial audit. Reviews of historical financial or other information by a practitioner other than the entitys auditor.

C statement of cash flows balance sheet and the statement of retained earnings. A balance sheet statement of retained earnings and the statement of cash flows. Organization is operating efficiently and effectively.

A financial audit is an analysis of the fairness of the information contained within an entitys financial statements. Management team is fulfilling its fiduciary responsibilities to shareholders. It is conducted by a CPA firm which is independent of the entity under review.

C statement of cash flows balance sheet and the statement of retained earnings. None of these choices. If reported sales for 2010 erroneously include sales that occur in 2011 the assertion violated on the 2010 statements would be A.

Introductory paragraph The first paragraph of the report does three things. A balance sheet statement of retained earnings and the statement of cash flows.

No comments for "An Audit of Historical Financial Statements Most Commonly Includes the"

Post a Comment